Enhance Risk Appetite

Management with

GIA Lite

Streamline commercial underwriting by aligning

submissions with product appetite criteria.

Beyond NAICS Precision

GIA Lite extends the standard six-digit NAICS framework into granular, underwriting-level sub-classifications. It recognizes that many carriers work with proprietary codes that go beyond NAICS conventions, and it aligns those codes to NeuralMetrics’ expanded index of business activities.

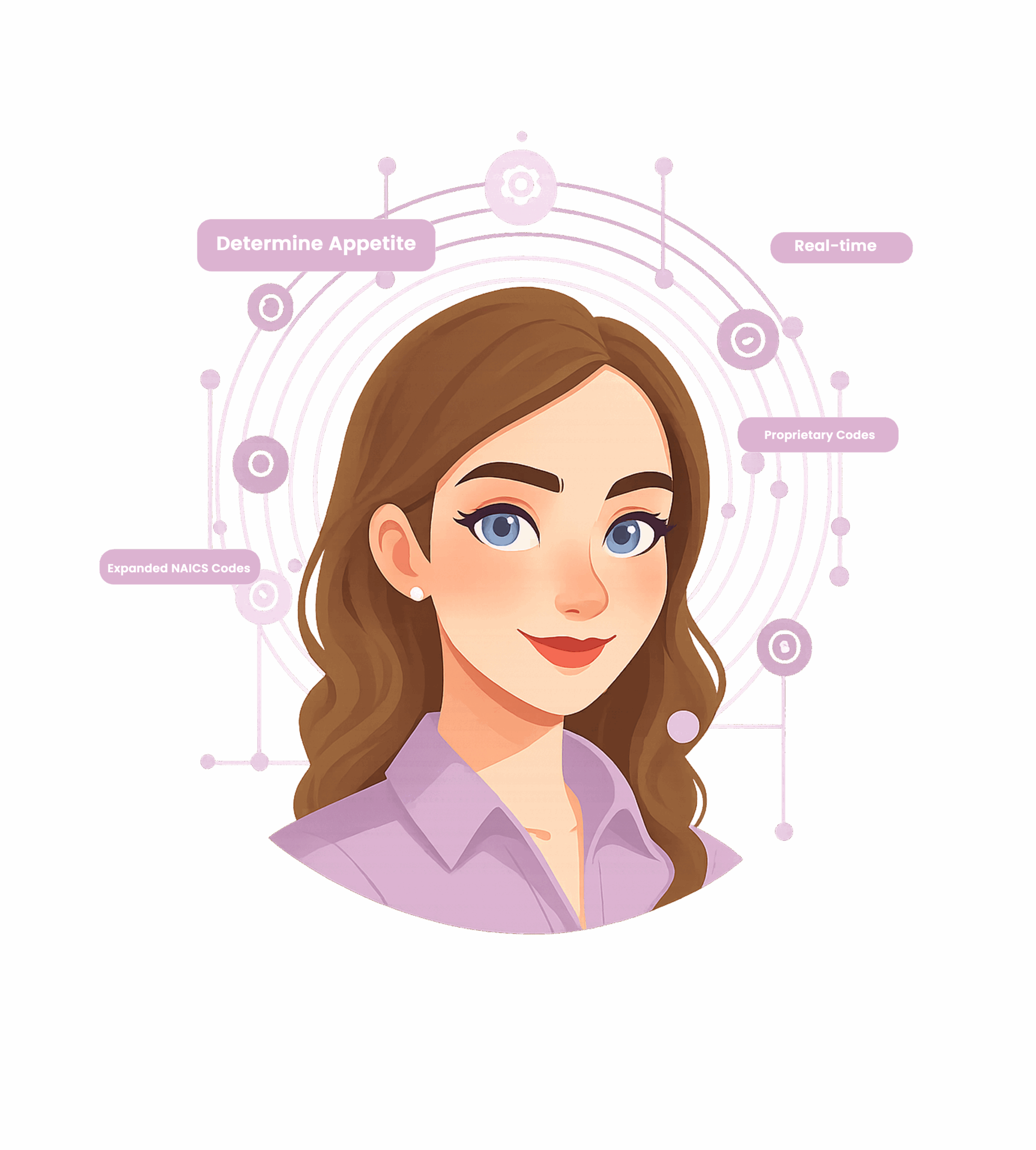

Meet GIA Lite – Intelligent Appetite Matching Assistant

Ingests carrier specific proprietary codes and matches to appetite.

Full contextual understanding, not keyword heuristics.

Built-in explainability and governance.

Instant universal propagation of your rules.

Global scale with multilingual capability.

GIA Lite Aligns Classification with Appetite

Real-Time Insights

Ensures immediate submission triage with instant appetite determination.

Class Expansion

Brings NAIC codes to the next level, aligning index entries to your appetite and codes.

Streamlined Workflow

Eliminate bottlenecks and reduce reliance on manual activities.

GIA Lite in Action –

Driving Smarter Risk Appetite Decisions

Enhance appetite and eligibility alignment for complex policies, reducing errors and improving accuracy

Increase underwriting team capacity to manage high-volume submissions

Slash turnaround times for new business, renewals, and endorsements

Discover how GIA dynamically aligns submissions with your underwriting guidelines,

boosting quote-to-bind efficiency and profitability.