Modernize Underwriting and Operations

Agentic intelligent solutions that deliver real underwriting and premium audit intelligence, not just automation.

Meet Our Suite of Intelligent Assistants

Our assistants don’t just talk to each other—they understand each other. Our platform standardizes how data, context, and decisions are exchanged.

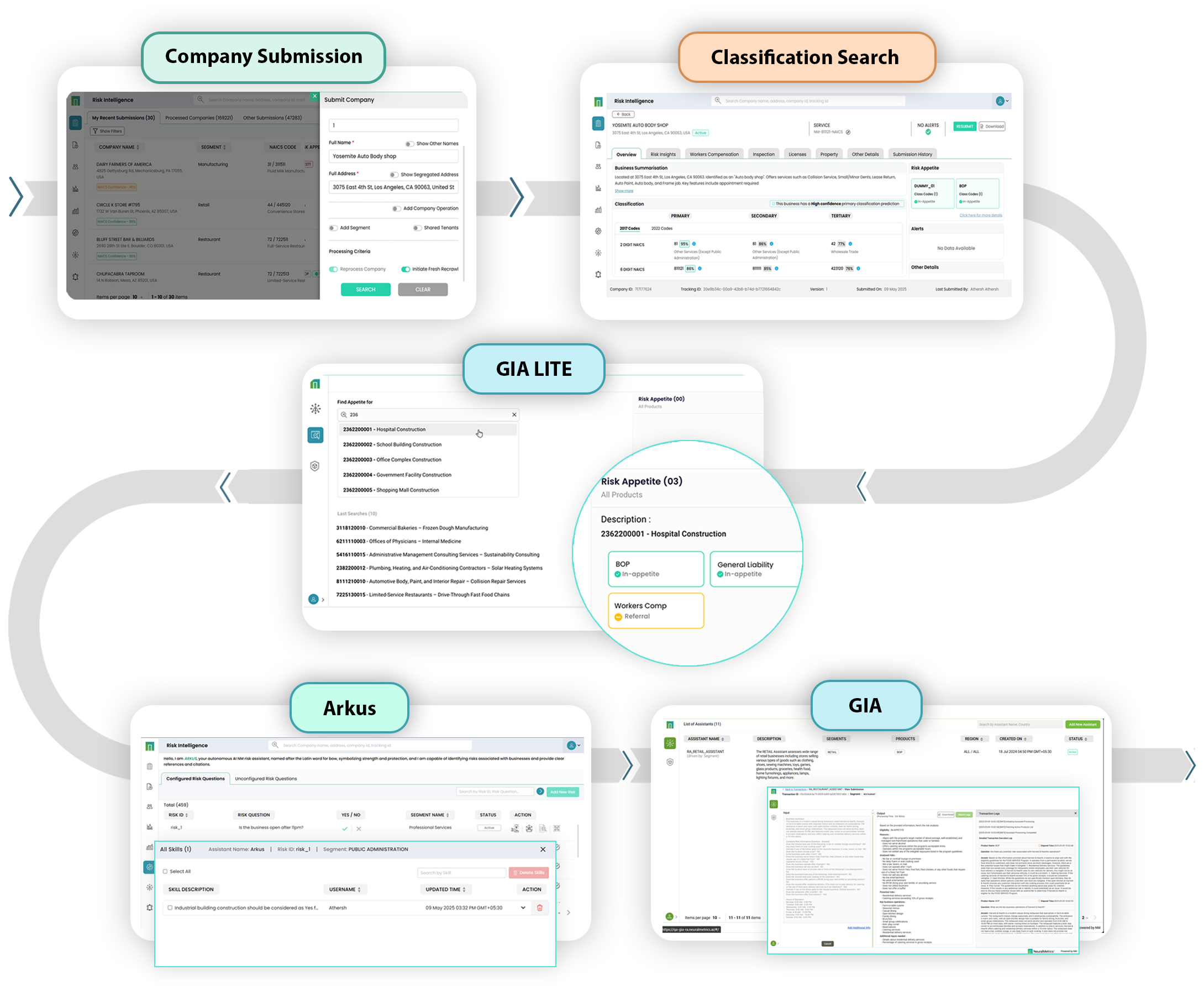

GIA Lite – Appetite Assistant

GIA Lite classifies the risk via NAICS, SIC, or any proprietary code.

Immediately determines whether the class code fits carrier appetite.

ARKUS – Risk Insight Assistant

GIA – Eligibility Assistant

Provides instant eligibility assessments based on tailored underwriting criteria.

CHRIS – Premium Audit Assistant

Validates audit data and identifies classification anomalies.

Streamlines manual workflows while improving accuracy and compliance.

The Value of NeuralMetrics Assistants

NeuralMetrics assistants transform commercial underwriting and premium audit processes, delivering speed, clarity, and confidence across every stage of your process.

Speed

Sppetite to eligibility in seconds, not days.

Transparency

Every decision is traceable.

Accuracy

Consistent rules from agent to underwriter.

The Intelligent Underwriting Workflow

Why NeuralMetrics

NeuralMetrics delivers state-of-the-art intelligent solutions to address the intricate challenges of commercial insurance underwriting and premium audit management. Our autonomous, role-specific assistants integrate seamlessly into your workflows, enhancing risk assessment accuracy, optimizing capacity allocation, and ensuring compliance.