NeuralMetrics Expands AI Capabilities for Commercial Underwriting and Premium Audit Efficiency. Read more

Standing Up Intelligence

We build Applied Intelligence — practical, explainable systems that let carriers and their data think together in real time.

We are the bridge between insurance organizations and real-time decisioning. We help insurers transform underwriting and audit speed, accuracy,

and transparency — without replacing the people who make it work

Intelligent Assistants

Every NeuralMetrics Intelligence Assistant is designed to elevate human capability. Our Agent2Agent digital co-workers collaborate just like functional teams — powered by standards like Model Context Protocol (MCP) for agent coordination and contextual trust.

GIA Lite - Risk Appetite Intelligence

Intelligent appetite matching, at the speed and depth that underwriters demand

ARKUS - Risk Insight Discovery

Real-time exposure intelligence and business classification for precise risk evaluation

GIA - Risk Eligibility Intelligence

Ingests underwriting guidelines to evaluate submissions for eligibility fit, pricing consistency, and portfolio impact

CHRIS - Premium Audit Intelligence

Streamlines premium audits with accurate classification, payroll validation, and compliance checks

Lessor's Risk Only

Identifies and classifies all businesses located on a shared property and evaluates how they may impact eligibility.

- Detects neighboring risks (e.g. explosives, nightclub).

- Supports strip malls, mixed-use and commercial buildings.

- Provides exposure insight beyond the primary applicant.

Property Risk Alerts

Customizable alerts based on commercial insurer and MGA needs.

Considerations such as:

- Nearby high risk business (i.e. fireworks factory).

- Whether an ATM is located on the property.

- Other location proximity factors that may affect eligibility .

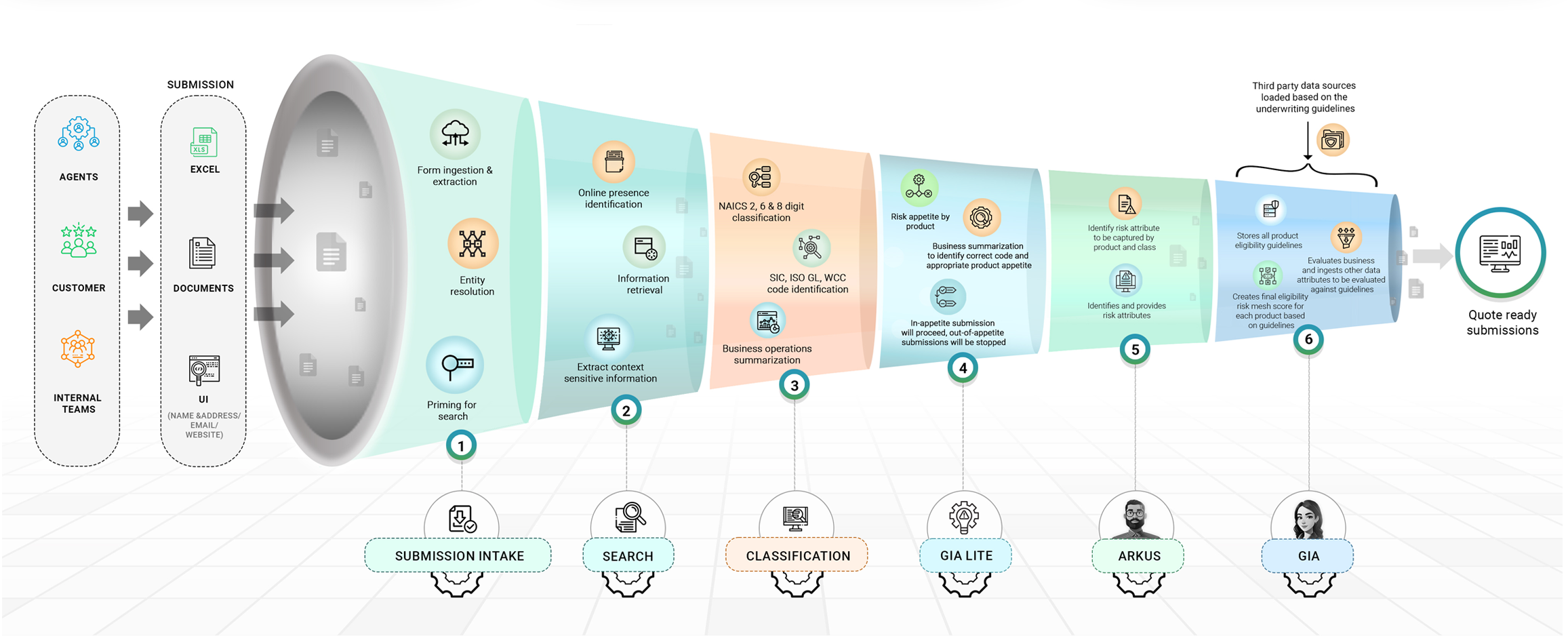

The Underwriting Solution

From submission intake (including document ingestion and extraction) to quote ready submissions, the NeuralMetrics Underwriting Solution is fast, accurate, and fully transparent.

1 – Submission Intake

We collect and standardize info from documents and customer inputs.

2 – Search

We gather public and online information about the business to understand what it does.

3 – Classification

We assign the correct

business codes

(NAICS, SIC, ISO GL, WCC, etc.) as well as your proprietary codes.

4 – Appetite

We check the business against the carrier’s appetite rules and instantly determine fit.

5 – Risk Attributes

We identify key risk factors for the business based on its product and class.

6 – Eligibility

We apply carrier eligibility rules to produce a final eligibility and create quote-

ready submissions.

Governance Proficiency Defines Our DNA

Governance defines how we build — role-based assistants that don’t just meet compliance, they operationalize it.

Rule Ingestion and Mapping

codifies guidelines and compliance standards

Data Lineage Tracking

traces every input from origin to decision

Regulatory Horizon Scanning

surfaces upcoming policy changes

Human-Above-the-Loop Oversight

retains final authority for the enterprise

Verifiable Trust Signature

preserves data provenance and model actions

NeuralMetrics is Committed to Quality, Compliance, and Data Security

Performance. Interoperability. Trust. In Production Today

NeuralMetrics assistants are delivering measurable benefits in the business transaction and policyholder service environments of inventive commercial insurance organizations.

60%

85%

accuracy in up-to-the-minute risk-quality insights

100%

40%

reduction in compliance cost efficiency

99.8%

50-70%

reduction of integration efforts via agent-to-agent deployment

Why NeuralMetrics

Powered by Applied Intelligence, we coordinate multiple AI assistants that reason together in real time — turning complex data into confident decisions

Client Value

Global Team

Modern Solutions

News and Insights

NeuralMetrics Expands Role-Based Agentic AI Capabilities for Commercial Underwriting and Premium Audit Efficiency

Product Enhancements Solidify InsurTech100 Award Recognition

From Black Box to Glass Box: AI Transparency is a Business Imperative

When an AI system produces an answer, users no longer ask, “Is this correct?” but instead, “Is this correct and can I defend the way the system arrived here?” Marcus Daley, Technical Co-founder, Neural Metrics.

How insurers can deploy agentic AI with confidence

The human-above-the-loop paradigm doesn’t just keep AI in check. It makes AI teachable, trustworthy, and transformational — elevating insurance operations while putting expert judgment exactly where it belongs: in charge.

5 Agentic AI trends reshaping insurance operations

“We’re seeing organizations across insurance adopt role-based agentic AI to boost operational acuity, compliance, and certainty,” said Prakash Vasant, CEO of NeuralMetrics.

Five GenAI Trends Impacting Insurance in 2025

Insurers and MGAs are upping the ante on AI. For the last several years, the industry has focused on the best ways to leverage generative AI, and many insurance organizations have used AI to increase efficiency, including the ability to integrate and analyze various data sources — such as scanned documents and information from diverse providers, third parties, and public domains.

4 Ways Generative AI Will Change Commercial Submissions in 2025

Streamlined operations, more tailored insurance product offerings, improved fraud detection, and faster claims resolution are all hallmarks of how generative artificial intelligence (AI) has helped improve insurance industry workflows over the past few years.

What Insurance Organizations Should Know About Open-Source AI

AI’s role in insurance represents a paradigm shift in how insurers approach risk assessment and other key processes. Open-source AI solutions, in particular, has been transformative, offering a new level of transparency and collaboration for insurers. Open-source AI has been instrumental in democratizing access to advanced technological solutions.

CEO View: How to Bolster Commercial Underwriting With AI Assistants

Having entered the business and technological mainstream two years ago, Generative AI is now helping to boost operations and cost efficiency across the insurance landscape. mong GenAI’s cutting-edge developments is the introduction of cognitive AI assistants that can learn, adapt, and collaborate to execute knowledge-based insurance tasks and processes independently.

NeuralMetrics Introduces Autonomous AI Assistants to Support and Modernize Commercial Underwriting Processes

With AI assistants GIA and ARKUS, insurer and program administrator/MGA underwriting teams can efficiently refine in-appetite risk selection, enrich exposure analysis, improve pricing and quoting accuracy, and enhance service to agents and policyholders.

NeuralMetrics Launches A-Star (A*) Platform Incorporating Intelligent AI Agents to Enhance Insurance Underwriting

Autonomous AI agents assume task-oriented personas and learn, adapt, and self-correct instantly to set new standards in data-driven commercial underwriting.

Autonomous AI Assistants Expedite Commercial Underwriting

NeuralMetrics CTO Sathish Manimuthu lists four ways commercial insurance organizations can use role-based AI assistants in their underwriting processes to boost capacity and strengthen data-driven risk evaluation.

How Can AI Boost Commercial Insurance Underwriting

AI agents can support underwriters with nuanced logic to quickly accomplish a range of risk-assessment tasks. According to Sathish Manimuthu, NeuralMetrics CTO, AI assistants help to increase the precision and productivity of underwriting teams.

Self-Learning, Reasoning AI Agents Can Improve the Commercial Underwriting Process

Autonomous AI agents can cost-effectively support underwriting processes by acting as intelligent assistants that learn and adapt to make designated risk-assessment decisions and execute appropriate actions without direct involvement from underwriters.

NeuralMetrics Launches Platform Using AI Agents to Enhance Insurance Underwriting

The A-Star Platform’s ‘SAMA’ autonomous AI agents can learn, adapt, and self-correct instantaneously to set new standards in data-driven risk analysis for commercial underwriting.

NeuralMetrics Launches Generative AI Underwriting Data Workbench

The NeuralMetrics underwriting data workbench is powered by generative AI and Large Language Model support. With the workbench as an intelligent navigator, commercial underwriters can enrich risk-assessment workflows, boost book-of-business consistency, expand risk appetites, and improve loss ratios.

NeuralMetrics and Binghamton University to Enrich Machine Learning via Quantum Computing

NeuralMetrics and Binghamton University announce collaboration to develop efficient quantum algorithms for training advanced language models — to support complex risk assessment with accelerated access to data and analytics.

Cincinnati Insurance Implements AI-Powered Solution for Underwriting Lessor's Risk Only Policies

With the NeuralMetrics Lessor's Risk Only (LRO) data solution, Cincinnati Insurance gains up-to-the-minute insights on tenant exposures and occupancy risks, and accelerates the quote-to-bind process.

Innovative Intelligent Solutions and Decision-Support Infrastructure Starts Here

Modernize compliance, scale operations, and strengthen trust with NeuralMetrics.